Retail & Business Banking Company

We will address challenges arising from the social and business environments surrounding our customers around the world, such as the new era of longer lifespans, sustainability transformation, digital transformation, and asset and business succession, by efficiently allocating corporate resources and undertaking growth investment to sustainably grow our customer base as we endeavor to shift to a phase of business growth and expansion. This will enable us to contribute to improved personal well-being for individual customers and support the growth strategies and business transformation of corporate clients.

Business overview

The company is in charge of the customer segments of individual customers, SMEs, and middle-market firms

*Materiality areas:

- Declining birthrate and aging population, plus good health and lengthening lifespans

- Industry development and innovation

- Sound economic growth

- Environment and society

Strengths

- Consulting and solutions that seamlessly leverage group-wide collaboration between banking, trust banking, securities and other business areas for both individual customers and corporate clients

- Capability to respond to customer needs and originate business, strengthened under the new branch network dedicated respectively to individual customers and corporate clients

- Broad network with startups/innovative companies, IT platform providers, and IT players

Focuses

- We will build up a comprehensive asset consulting framework to provide robust support for individual customers' asset formation and management. In addition, we will provide solutions and risk capital to middle market firms, SMEs, and startups/innovative companies for which business succession or growth is expected.

Optimization

- We will simultaneously upgrade the quality of customer services and boost operational efficiency by improving digital channels, which will enable us to improve customer experience by shifting human resources to provision of consulting and solutions.

Measures to achieve medium-term business plan

We will improve customer experience by providing highly convenient digital services enabling various transactions to be completed without visiting our locations, while at the same also bolstering our capacity to serve customers either at branches or remotely by placing importance on customer touchpoints. For individual customers, we will meet their asset formation and management needs by means of highly convenient service channels and comprehensive asset consulting; for corporate clients we will provide high added-value solutions leveraging Mizuho's know-how, insight, and networks.

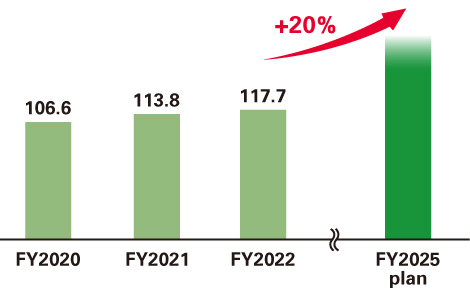

Balance of individual assets under management (JPY trillion)

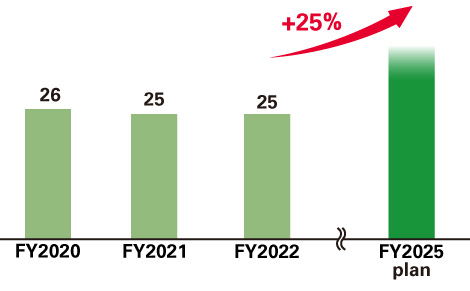

Revenues from Corporate Solutions (JPY billion)